Do I Need to Create a Pay Stub for my Nanny?

Hiring a nanny means you hiring a contract worker. This means you are in charge of paying their salary on time on a given pay period. Paystubs are the easiest way to pay your nanny.

This post will explore your options whether you want to generate your own nanny paystubs. Or hire a payroll service.

Your to-do list might be undoubtedly filled, this is why we offer simple steps for creating check stubs for your nanny so that you can stay on top of taxes and compliant with state regulations on hiring child care professionals.

Things to Include in a Nanny Pay Stub

Pay Periods for a Nanny should include All their Work Hours

If you are paying your nanny the federal minimum wage, you are required to pay her for all time worked. This includes work outside of your home, travel time to an event, etc. Her travel time to an event must be at least equal to the time she spends at the event.

There are certain situations where you are not required to pay for your nanny's time. For example, if she is sick, you are not required to pay her. You are also not required to pay your nanny if she takes vacation or time off. However, if she is sick, she must continue to work for the time period she was originally scheduled to work.

If your nanny requires proof of income then you can give them a pay stub to show their salary and taxes withheld. If they don’t require proof of income, then you can just give them a pay stub for their own records. It’s always a great idea to give them a copy of both sides of their income tax form.

The biggest issue with nannies is that many people are not aware of the laws surrounding the work they are doing. It is important to know that if you are using a nanny, you are required to pay her for all hours that she works. If she is sick and you continue to schedule her, you must pay her for that time.

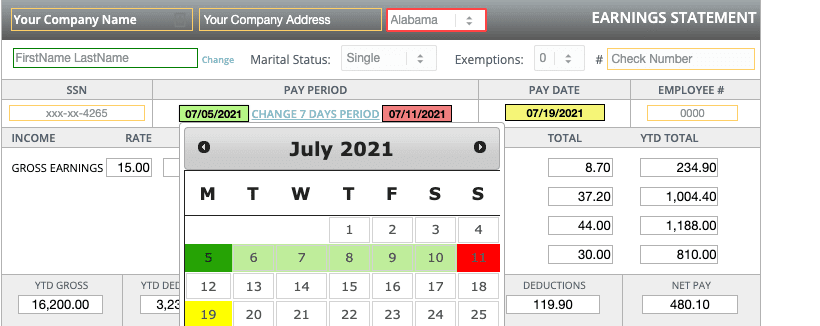

When calculating nanny taxes there are a few different things to consider:

How much is your nanny paid?

How many hours do they work?

What is their marital status?

What state do they live in?

If your nanny is paid hourly then you will need to calculate gross pay and net pay. And all of these are easily managed if you take advantage of using an easy pay stub generator which will help you make your calculations and features dynamic values and computation for taxes.

For example, let’s say your nanny works 30 hours a week at $10 per hour.

Their gross pay would be $300, and then you would divide that by 30 to get an hourly rate of $10.

How to Calculate Nanny Pay by the Week For a nanny who is paid by the week, you would divide their gross pay by the number of hours they worked in the week to find their weekly rate.

For example, let’s say your nanny works 35 hours a week at $11 per hour. Their gross pay would be $355, and then you would divide that by 35 to get an hourly rate of $11. Their weekly pay is $355, and then you would divide that by 5 days to get an hourly rate of $71.

You don't have to overthink it, just pay what your nanny gives you. Remember the great thing about using our online check stubs is you can make changes off the cuff! Keeping your nannies and babysitters happy is a sure way to keep them friends and making sure they can cover for you when you're away from your kids.

What is a Nanny Payroll Service?

If you hire a nanny and there are too many pay periods to navigate, then you may consider gives you is the ability to manage your finances and pay your nanny through your own personal accounts, as well as giving you the ability to find a way to give them raises or bonuses without having to go through the hassle of calculating that yourself.

One of the benefits of outsourcing your payroll is that you will be able to ensure that all of your taxes are paid in a timely manner since the payroll service will be able to handle that for you, they will also provide you with an employee manual so that you can ensure that your nanny knows what their responsibilities are and knows how much they will be expected to work.