How to Create Pay Stubs for Independent Contractors

Independent contractors are typically not given pay stubs.

If you offer a service and get paid for it and you don’t work for a specific employer for long periods of time, then you are an independent contractor.

Pay stubs for independent contractors are their invoices and it is perfectly possible to generate one online.

Is there a pay stub for independent contractors?

Pay stubs are forms or documents created to record income for a given period of time and payroll deductions including taxes and healthcare.

These forms can be given by an employer but if you’re self-employed you can generate your own pay stubs too.

It’s important not just to take cash in hand, you need to track your income because that gives useful information for taxes.

Paystubs for independent contractors should contain in their forms, the following fields: gross pay, net pay, state taxes, federal taxes.

What about a 1099?

When is a Pay Stub Useful for an Independent Contractor?

Pay stubs are vital for income taxes.

If you earn above a given threshold, $600 for example on a consistent basis, you will need to file taxes.

Paying your state and federal taxes also keeps you from incurring penalties from the IRS and makes your transactions move much faster.

The IRS wants people to identify if they are offering services as employees or as independent contractors. Making sure you pay yourself in time helps to establish yourself as a contractor and recording your payments gives you proper documentation in real time.

Pay stubs are good for proof of income.

If you need a home loan or car loan or any other huge purchase, you will need proof of income.

Even if you’re working as an independent contractor, tracking your earnings in real-time is ideal so that you can prove your income conveniently.

Pay stubs give you a clear track record

If you want to finance a project, or you want to collaborate and gain venture capital, you will need to prove your income given a veritable track record so your future investors will know of your stature.

Pay stubs show you’ve been working and earning for the given periods that you say you are.

Pay stubs help you with savings

You can also participate in a retirement or savings plan and track things much faster if you record your income.

Check stubs are your invoices so making sure you generate them and keep them is paramount for your savings and your long-term retirement plans.

Recommended Reading:

How do independent contractors make pay stubs?

Make your own using free software

Find a pay stub template online and port it over to Microsoft Word or Excel.

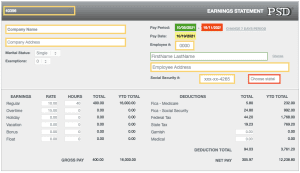

Use free online tools to generate one yourself. You can also use our pay stub templates to sample what a pay stub looks like.

Create a pay stub with an online pay stub maker

Online pay stub generators make pay stub creation much faster because the calculations are automatic.

They contain free PDF previews and you can change them as many times as you like.

Online pay stubs also contain vital information like your state and employer-employee details.