What are Pay Stubs Used For?

Pay stubs may or may not be required by federal law for employers to give to their employees.

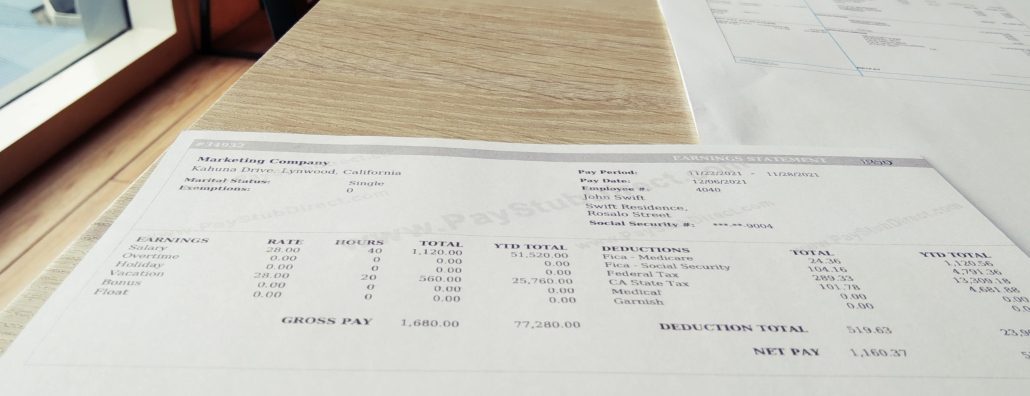

Pay stubs or check stubs are very handy documents that have many practical uses in the real world.

It might surprise you how many people don’t have their stubs in hand when people like employees are required to produce them beyond just the usual payroll functions.

Recommended Reading: What is a pay stub

7 Scenarios Where You will Need a Pay Stub

-

Proof of Income

If you’re going to be self-employed and you’re earning more than $400 you’re going to have to prove your income.

This is often the benchmark of all the other uses of a pay stub or check stub.

You can also track helpful information about your net pay in general and how you can improve.

Measures including your YTD or year to date are great metrics for measuring your progress as a working woman or man.

-

Pay stubs are great for Taking Out a Loan

You’re going to need pay stubs to show your consistent periods of earning if you need a loan.

If not for proving income, it shows you can hold a steady job or a steady flow of money which will then ensure the lenders that you are capable of paying out a loan.

-

Renting

If you’re moving into a new part of the city or striking out on your own, renting an apartment will require you to show proof of income.

Sometimes, you may need several weeks or more for check stubs to show that you can really cough up the rent money when it’s needed.

-

Car loans

If you apply for an auto loan, it’s similar to other types of loans.

Lenders always make sure that you can pay them back.

Some ask for a recent pay check stub you have, while others may actually require you to showcase some pay stubs which took place several months.

-

Tracking your finances

If you’re receiving payments from multiple accounts, it might be easy to get sidetracked.

Using pay stubs ensures that you don’t get diverted with any red herrings and if there are any discrepancies, you can keep track of them right away.

-

Staying on top of federal and state taxes

You may need to check your local state laws.

States like Texas, South Dakota, Nevada and Alaska generally don’t require state taxes.

In the context of paying your taxes and doing everything in a legit fashion, you must stay ahead of your taxes.

Pay stubs also show deductions like your pension payments.

Recommended Reading: Payroll Deductions

These are factors that influence the amount of tax you'll owe, so having simple evidence for them can speed up the process.

-

401k’s and Retirement

Keeping your pay stubs ensures you can withdraw up when it’s time to retire.

Millennials retire at the age of 67 so having a consistent track record of your income allows you to take care of your financial future.

And in general paycheck stubs are your foundation for proving and showcasing your earnings which then affect your present fiscal health.

Make Paystubs with PayStub Direct

We at PayStub Direct can help you in making your own paystubs.

Just input the necessary information and we'll auto-calculate everything for you.

It's that simple!