Clean Pay Stubs

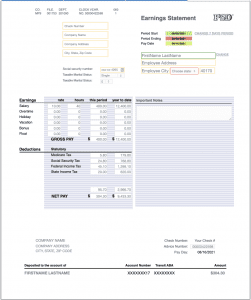

A modern layout designed for clear, professional self‑employed income records.

Modify Stub

Preview

Latest Stub

(fill in your info, we calculate all stubs backwards from current)

Past Stubs

(automatically generated but editable)

Self‑Employed Income Records (Clean Layout)

Most rental applications require proof of income—and they often want it quickly. If you’re self‑employed, a 1099 contractor, or your employer doesn’t provide a payroll portal, you can still document legitimate earnings with a clean paystub layout that’s easy for property managers to review.

Good fit if you…

- Need proof of income for a rental application

- Get paid by a small business that doesn’t issue formal paystubs

- Work as a contractor and need standardized paperwork

- Need historical stubs for past pay periods (legitimate earnings)

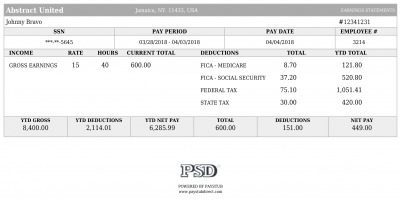

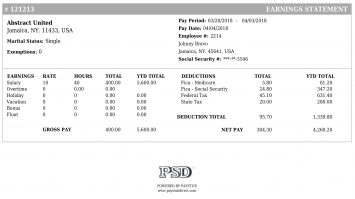

What landlords usually review

- Pay period dates and year-to-date totals (if applicable)

- Employer/payor name and your name

- Gross pay, deductions, and net pay

- Consistency across recent pay periods

Example (illustrative) rental-ready paystub setup

- Use case

- Apartment application income verification

- Pay frequency

- Bi‑weekly (consistent schedule)

- Requested docs

- 2–3 recent pay periods + supporting deposits

- Tip

- Keep totals aligned with bank deposits/invoices

How to use this for a rental application

Enter amounts that reflect actual earnings (bank deposits, invoices, statements). Consistency matters more than “perfect” numbers.

For rentals, recent paystubs are usually requested. If you need historical stubs, keep them aligned with your real timeline.

If asked, be ready to show bank statements, contracts, or invoices that support the income shown on the paystub.

Common rental requirements (and how this helps)

2–3 months of stubs

Many landlords ask for 2–3 consecutive months of paystubs. This template helps you present those pay periods in a consistent, easy-to-read format.

Income-to-rent ratio

Property managers often check that monthly income meets a required multiple of rent (e.g., 2.5×–3×). A clear paystub makes that calculation easier.

Frequently Asked Questions

How many paystubs do I need for an apartment application?

Most landlords and property managers require 2 to 3 consecutive months of paystubs to verify income consistency.

What if my employer doesn't provide paystubs?

If you work for a small business or are self-employed, you can use our generator to create standardized records of your legitimate earnings to provide to your landlord.

Will landlords accept these paystubs?

Yes, landlords accept professional paystubs as long as they accurately reflect your verifiable income. Always ensure your totals match your bank deposits for a smooth application.

Related (helpful) pages

PayStub Direct provides tools for legitimate income documentation only. Always enter accurate information that reflects real earnings.