PAY STUB MAKER ONLINE – CREATE YOUR OWN PAY STUBS!

How to make pay stubs is something you’re going to have to learn if you own a small business.

It’s important to have these skills because an online pay stub is crucial in being able to operate.

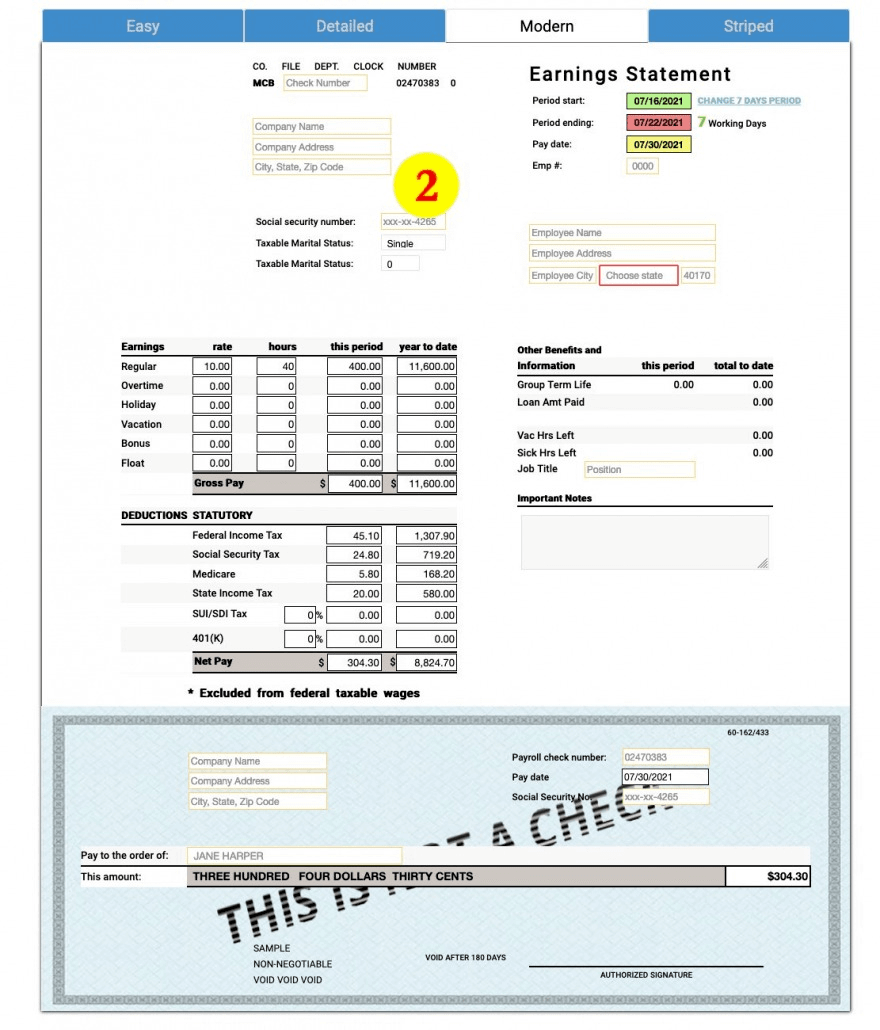

Of course, the easiest way is to get an online pay stub maker and make sure the template follows the standardized rules wherever you are. If you own a small business where there are only a few employees you can handle, then it’s paramount that you oversee things yourself. Learning how to make a paystub using a free paystub generator online can be the way to systematize your workflow.

Here are some of the key considerations in taking advantage of a pay stub generator.

Gross pay

This is important. The amount you render as theirs sans deductions would then be deducted from federal taxes and other remittances. You should take note of these amounts and make sure that once you input them into the paystub, the dollar amounts are accurate.

Number of hours

Do your staff work on a regular 9 – 5 or 12 – 9 shift? Then take note of that. If there are some weeks where they may be on the field hence their work hours are extended or shortened? Then take note of those as well. How to make a pay stub is just the first step, actually organizing it is key.

Net pay

Also, when it comes time to net pay, this is their take-home pay. So it’s important that you compute these properly and make sure the deductibles are all in place. You should check the deductions and remittances to make sure the amounts you leave here are all precise.

State taxes

State taxes and federal taxes are all things to account for. So make sure that it matches with the current requirements of your state. You may need to hire an accountant to make sure of this but if you’ve got a handle with a few employees, then you can of course make sure that these state taxes are in handy. State and federal taxes also go hand in hand with social security and any insurance you may be enrolling them with.

Pay periods

Make sure you encode them right before their pay periods and that submissions are on time. It’s easier if you come up with a routine at what point during the month you are going to make your encoding.

Following a standardized workflow and submission periods is good because you can easily ensure that your employees get paid on time and you have put your pay check stub maker to good use.

Using a free paycheck generator, you can easily learn how to make a paystub. Managing your time though is the ultimate way you’re gonna get around to properly compensating your employees and making sure their proof of income, their hours worked, their gross pay, applying for a loan and other things are properly in order.

Another helpful tip is keeping a master list of all your employees, this way you can generate their pay stubs easily without worrying which name goes where. It’s all in a day’s work.