Simple Pay Stubs

Fast, clean pay stubs for freelancers and small employers (legitimate income records).

Modify Stub

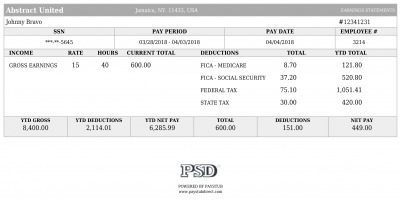

Easy

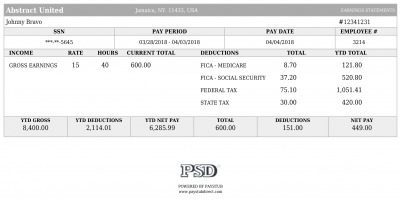

Easy Advance

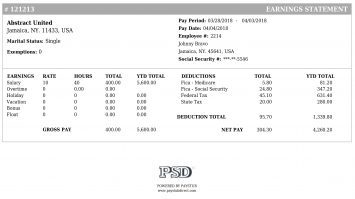

Advance Modern

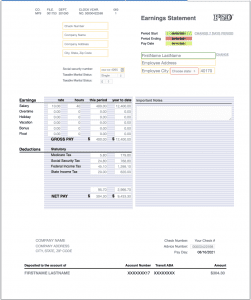

Modern Striped

StripedPreview

Latest Stub

Fill in your info below — we calculate all stubs backwards from this one

Latest Stub

(fill in your info, we calculate all stubs backwards from current)

Past Stubs

(automatically generated but editable)

Simple Pay Records (Freelancers & Small Employers)

Freelancers and independent contractors are their own HR department. If you need proof of income, a consistent record for your accountant, or historical stubs for real past earnings, this template keeps it simple while still looking professional.

Good fit if you…

- Work as a freelancer, contractor, or consultant

- Need proof of income for a new lease or service

- Need to document historical earnings (legit work you did)

- Want a clean stub without complex payroll software

Common legitimate uses

- Income verification (rentals, subscriptions, services)

- Record‑keeping for taxes (1099 + bookkeeping)

- Budgeting and tracking net pay

- Providing consistent pay history when switching jobs

Example (illustrative) freelancer self‑payroll setup

- Use case

- Proof of income + clean records for taxes

- Cadence

- Monthly (common for freelancers)

- Source of truth

- Invoices/contracts + bank deposits

- Tip

- Keep dates consistent with when you were paid

Best practices for freelancers/1099

Use invoices, contracts, and bank deposits as your source of truth so the stub reflects real work and real money.

Monthly is common for freelancers; bi‑weekly can work if you pay yourself on a schedule.

For verification, pair paystubs with a 1099‑NEC, Schedule C, or bookkeeping reports when asked.

Why a simple stub helps

Quick income proof

A clean paystub format is easier for third parties to understand than a pile of invoices.

Clean records for tax season

Consistent documentation makes it easier for you (and your accountant) to reconcile income across months.

Frequently Asked Questions

Do independent contractors need to give themselves paystubs?

It is highly recommended for record-keeping and is often necessary when applying for health insurance, loans, or verifying income for taxes.

Can I create historical paystubs?

Yes. If you need to back-fill records for past work months where you didn't have a system in place, our generator allows you to accurately document those legitimate earnings.

Is this a legitimate way to prove self-employment income?

Yes. Providing a professional paystub alongside your 1099-NEC or Schedule C tax form is a standard way to verify income for self-employed professionals.

Related (helpful) pages

PayStub Direct provides tools for legitimate income documentation only. Always enter accurate information that reflects real earnings.