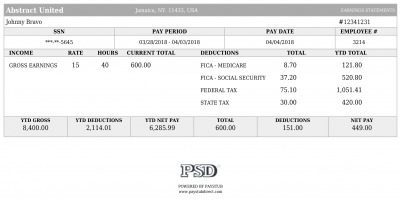

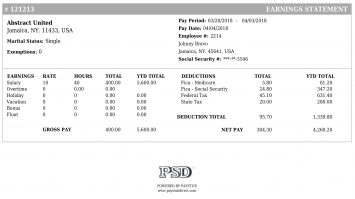

Detailed Pay Stubs

Includes YTD totals and deductions for complete payroll record‑keeping.

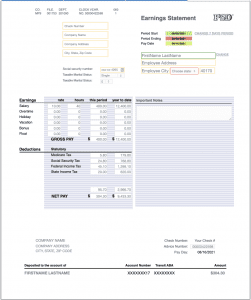

Modify Stub

Preview

Latest Stub

(fill in your info, we calculate all stubs backwards from current)

Past Stubs

(automatically generated but editable)

Detailed Payroll Records (YTD + Deductions)

For mortgages and auto loans, lenders typically want a complete paystub view: pay period dates, year‑to‑date totals, and standard deductions/withholdings. This template is designed to document real income in a lender‑friendly format—especially when you’re self‑employed or your payroll process is manual.

Good fit if you…

- Need paystubs for a mortgage application or auto loan

- Are self‑employed and pay yourself regularly

- Run a small business and need consistent payroll records

- Need lender‑friendly detail like YTD and deductions

What this template emphasizes

- Year‑to‑date totals and clear pay periods

- Common tax withholdings and deductions

- A layout that resembles traditional payroll stubs

- Professional formatting for printing or PDF upload

Example (illustrative) lender-friendly setup

- Use case

- Mortgage or auto loan application

- What to include

- Pay period dates + YTD totals + deductions

- Consistency

- Use a stable pay schedule (weekly/bi‑weekly/monthly)

- Supporting docs

- Bank statements and tax records (when asked)

How to keep it lender‑friendly (legit)

Choose weekly/bi‑weekly/monthly and stick to it. Underwriters look for stability and repeatability.

YTD totals should reflect cumulative earnings for the year up to the pay date. Inconsistencies can delay verification.

Self‑employed borrowers are often asked for tax returns and bank statements—keep them aligned with the paystub numbers.

Why lenders care about “detail”

Verification + underwriting

Banks verify income to ensure the payment is affordable and consistent. Clear pay periods and totals help them confirm your earning history.

Deductions & withholdings

Standard withholdings make the stub look like a traditional payroll document and help a lender interpret net income correctly.

Frequently Asked Questions

What do lenders typically look for on paystubs?

Lenders commonly look for pay period dates, YTD totals, and standard deductions/withholdings so they can verify income stability and consistency.

Why are YTD totals important for car loans?

Lenders use YTD totals to confirm that your current pay period is consistent with your annual earnings history, reducing their risk and speeding up your approval.

Is this only for employees?

No. If you are self‑employed or a business owner paying yourself, you can document real income in a standard paystub format for verification needs.

Related (helpful) pages

PayStub Direct provides tools for legitimate income documentation only. Always enter accurate information that reflects real earnings.