List of Pay Stub Abbreviations

Pay stub abbreviations are the shortcuts or abbreviations which you encounter on any pay stub.

Payroll companies truncate or abbreviate the words which are printed for shorthand and easier reading.

It also takes up lesser space on paper – or in an online paystub!

Payroll practitioners often use these abbreviations as their own form of shorthand.

This article will explore these shortcuts so that you won’t get lost the next time you receive your check stubs.

Why it is important to understand Pay Stub Abbreviations

You won’t get lost.

In taking a peek at your paycheck, you want to make sure what it is because particularly in the topic of payroll deductions, every abbreviation relates to another.

Certain companies impose their own abbreviations.

Some companies have their own abbreviations or their own ways of using established shorthand.

You can ask for clarification for payroll changes.

Understanding abbreviations gives you the advantage of being able to ask for clarification or requesting for changes if there are errors on your paystub.

Full control of taxes and deductions.

Understanding shortcuts also gives you full control over taxes and deductions.

You won’t gloss over certain areas in your paystub. You will understand what they mean and that will give you leverage once you start calculating your taxes.

General Pay Stub Abbreviations

These are general abbreviations that are used on almost any paystub. They are fundamental parts of a paycheck stub and familiarizing them, particularly when you’re just starting to earn can help you navigate your payroll checks.

EN - Employee Name

Employee name – your full name

SSN - Social Security Number

Social security number.

EID Employee ID Number

This number is specific to the company you work with

YTD - Year to Date

The amount of earnings or deductions from a payroll year’s start.

Recommended Reading: What is YTD on a pay stub?

Income Pay Stub Abbreviations

These relate to income or your regular earnings. Not all companies use these, but here is an overview of how some paychecks use this form of shorthand to relate information pertaining to income.

SLRY - Salary

The amount you earn for a given pay period.

HR - Hourly

Your hourly wages. If your hourly rate is $10 per hour, you will get paid that amount for every hour you work.

HRS - Hours

Your total work hours in a pay period.

REG - Regular Pay

Regular pay, earnings for work performed in a specific pay period.

SI - Supplemental Income

This is additional income which is separate from your normal salary.

OT - Overtime Pay

Overtime pay is paid at 1 and ½ times your normal salary rate. These are hours worked above your usual working periods.

Sometimes, these can be recorded as OT@1.4 or OT@2 meaning over time at one and a half times or two times the salary respectively.

PTO - Paid Time Off

This is akin to a vacation leave. Some companies also offer a mental health day, whether those are paid or not is up to the management.

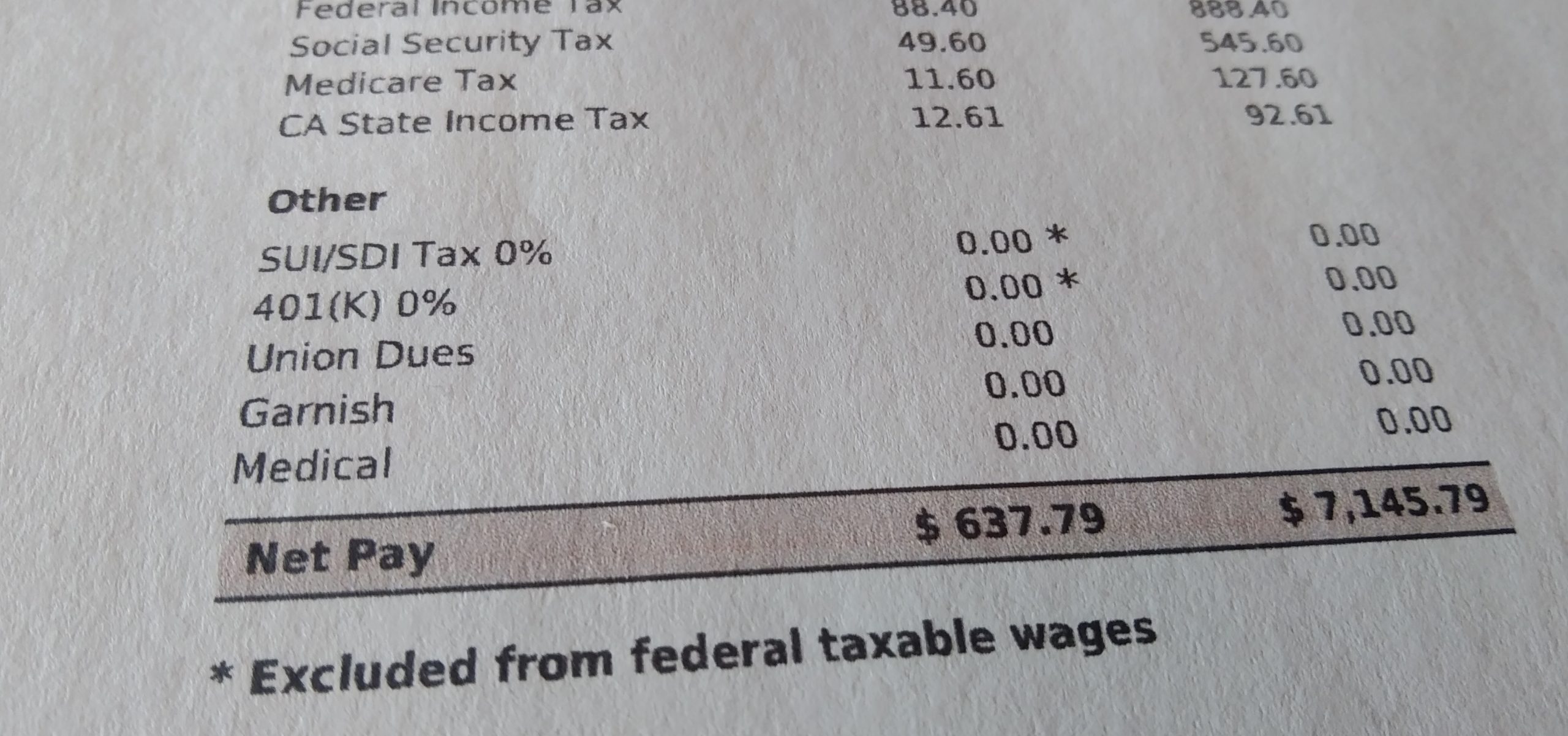

Pre-Tax Deductions Pay Stub Abbreviations

Pre-tax deductions are those which reduce your taxable income. They are taken out of your income prior to taxes. You can take advantage of these deductions so that they won’t be included in your regular taxation.

Federal and state taxes can change policies so it’s best to do your research beforehand.

401k/Ret

401k or retirement withholdings. 401k's are usually offered by employers and if you pay on time, you will often get tax advantages.

DCR - Dependent care reimbursement

Dependent care reimbursement a good idea for those who have the extra funds to invest. The amount that you can put into a DCR account depends on what your employer permits

DEN - Dental Premium

Having dental coverage is good for employees who want to get their teeth cleaned or looked at on a regular basis without having to shell out the extra money.

INS/MED - Insurance or Medical Insurance Payments

Insurance or medical insurance can be coursed through a preferred provider organizations. You will be coursed through a list of hospitals or providers who can give you this assistance.

FSA - Flexible spending amount

Flexible spending amount is indicated by the employer. It can often cover dental, vision or prescription drugs.

HSA - Health Saving Amount

HSA allows you to set aside money on a pretax basis in order to lower your medical costs.

LTD - Long term disability withholding

Long-term disability insurance is a type of coverage that insures an employee’s ability to earn an income if they are unable to work for an extended period of time due to a disabling injury or illness.

STD - Short term disability withholding

Short-term disability insurance, on the other hand, is a type of coverage that insures an employee’s income for a shorter period of time if they are unable to work due to a disabling injury or illness.

VIS/Vision - Vision premium

There premium can vary depending on the insurance company and the specific policy. However, in general, vision premium is an additional amount that may be charged on top of the regular premium for coverage of vision-related expenses.

This can include things like routine eye exams, glasses or contact lenses, and even corrective surgery.

Tax Pay Stub Abbreviations

If you use an online pay stub generator, there are some tax abbreviations which are pretty much ubiquitous and widely used in the States. Taxes will depend on your state or city.

FED Tax - Federal income tax withholdings

The federal tax withholdings are taken out of an employee's paycheck in all fifty states. State taxes however, are only withheld in some states.

The states without state taxes are: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

FICA - Federal Insurance Contributions Act

FICA coverage is a type of insurance that covers medical expenses and income lost due to illness or injury. It is typically provided by employers and may be required by law.

FICA/MT - FICA Medicare Tax

Medicare tax, usually 1.45% of a person’s taxable income.

FICA/SS - FICA Social Security

Social Security. Social Security taxes are around 6.2% of taxable income up to a certain limit on the tax year.

FUTA - Federal Unemployment Tax.

This is a federal payroll tax which is used to match state unemployment funds. It is paramount for employers who pay wages which are subject to unemployment payroll taxes.

ST - State income tax withheld.

The state tax can be abbreviated to the shortcut of the state e.g. NYC Tax, CA Tax, etc.

SUI - State unemployment insurance.

This amount will depend on the tax year. Amounts which are withheld on your wages may also depend on how much you pay into your SUI program.

After Tax Deductions – Pay Stub Abbreviations

After tax deductions are withheld from your paycheck after taxes are calculated. These do not affect your tax amounts.

Bankrpty - Bankcruptcy

If your company has filed for bankruptcy, your pay stub will likely reflect this fact. Your pay stub may show that you are owed less money than you are actually owed, or it may show that you are not owed any money at all.

CHD SU Child support.

Child support in a pay stub means that the employee's wages are being garnished in order to make a child support payment. The amount of the garnishment will depend on the amount of child support that is owed and the employee's wage.

Garn - Garnishment flat rate

Garnishment flat rate is the percentage of wages that can be garnished for a particular debt. The most common debts that result in wage garnishment are child support, alimony, and back taxes.

Garn% -Garnishment percentage

The usual garnishment percentage in most States is 25%.

StdnLoan - Student Loan

Student loan on a pay stub means that a portion of an individual's paycheck is being garnished in order to repay a student loan. The amount of the garnishment will depend on the terms of the loan and the amount of the individual's income.

IRS Levy - Internal revenue service levy

The IRS levy on a pay stub is a tax that is imposed on the wages of an individual. This tax is used to fund the operations of the Internal Revenue Service.

R401 Roth 401(k) contributions

Roth401k is a retirement savings plan that allows employees to contribute a portion of their paychecks to a Roth 401(k) account. This account is then invested and grows tax-free until the employee retires, at which point they can withdraw the money without paying any taxes on it.

ESPP - Employer sponsored pension plans

ESPPs are employer-sponsored retirement plans that allow employees to contribute a portion of their paycheck to an investment account.

The funds in the account can be used to purchase stocks, bonds, or other investments. The account is typically managed by a financial institution, and employees can often receive matching contributions from their employer.

C529 - 529 college savings plans

A 529 college savings plan is a tax-advantaged account that can be used to save for college. The money in the account can be used to pay for tuition, room and board, books, and other expenses.

UD - Union dues

What are union dues on a pay stub? Union dues are a type of payroll deduction made to a labor union.

The funds are used to support various union activities, including negotiating contracts, handling grievances, and providing other benefits to members.

VIS - Vision premium

VIS or Vision Premium is a deduction from an employee's paycheck that goes towards the cost of their vision insurance.

This deduction is made pre-tax, meaning it is taken out of an employee's paycheck before taxes are calculated. This can help to lower the overall cost of vision insurance for employees.

Other Pay Stub Abbreviations

Again, pay stub abbreviations and shorthand are unique. So you may or may not encounter some of these. Just in case you switch companies or retrieve some of your older stubs for tax filing, here's some more additional terms which can help you understand your payslips.

ACR - Accounts receivable

The total amount of money owed by customers.

ACT - Acting Pay

Acting Pay means the rate of pay an employee receives while temporarily performing the duties of any rank higher than the employee normally holds.

ADM -Administrative Leave

Administrative leave is a temporary leave from a job assignment, with pay and benefits intact.

HCSA - Health Care Spending Amount

The HCSA health care active spending amount is the total amount spent on health care by all active members of a health care plan.

This includes both the amounts paid by the members themselves and the amounts paid by their employers.

COB - COBRA, spouse child after tax

COBRA is a continuation of health insurance coverage that is provided by an employer.

CNT Pay - Contract pay salary

There is no set salary for CNT employees. Wages are typically determined by the contract between the employer and the employee.

ERP ERTaxPre - Early Retirement Tax Prepaid

ERPTaxPre is a tax-prepaid retirement account that allows employees to contribute a portion of their salary to a retirement account and receive a tax deduction for the contribution.

Employees can make contributions to the account on a pretax basis, which reduces their taxable income.

ERTaxabl - Early Retirement Taxable

Early retirement is taxable in the same way as regular retirement. This means that you will likely be required to pay taxes on any income you receive from pensions, investments, or other sources.

FMLA Family and Medical Leave Act

The Family and Medical Leave Act (FMLA) is a law that gives eligible employees up to twelve weeks of unpaid, job-protected leave per year for certain family and medical reasons.

FSA - Flexible spending amount

FSA is the money that comes out of your paycheck before taxes are taken out. After taxes are subtracted, you're left with your net pay.

Here's an example of how it works: Let's say you've designated $60 from your pay to go into your FSA account. This means you won't have to pay taxes on that money, which saves you money. If you make $45,000 a year and are in the 25% tax bracket, this would save you about $15 in taxes.

FSS - Faculty Summer Salary

What is FSS Faculty Summer Salary? The Faculty Summer Salary (FSS) program is a federal program that allows eligible faculty members to receive additional compensation for teaching, research, or public service activities during the summer months.

The program is administered by the US Department of Education and is available to institutions of higher education that participate in the Federal Pell Grant program.

HCR - Health Care Reimbursement

HCR is a health care reimbursement system that allows individuals and families to receive reimbursement for health care expenses incurred. The system is designed to reimburse health care providers for the costs of care provided to enrollees.

TUI - Tuition Reimbursement

TUI tuition reimbursement is a benefit that TUI offers to its employees. The benefit allows employees to receive up to 100% reimbursement for their tuition costs, up to a certain limit.

Vac - Vacation Pay

If your employer does offer vacation time, there may be rules about how that vacation time can be used.

VPT - Vacation Payout

Most employers in the United States do offer some kind of vacation benefits to their employees, although the amount of time off and the way it is accrued may vary from company to company.

The most common vacation benefit is two weeks of paid time off per year. Some companies offer more, and some offer less.

How We Can Help

Pay stub abbreviations can vary from employer to employer. Understanding them can be useful, but it's vital to understand how those pay stub shortcuts vary from state to state.

If you're self-employed or have been working as an employee, recording your income is paramount. Catch up on your invoices through creating your own online pay stubs.