What Does Pay Period Mean?

What is a Pay Period?

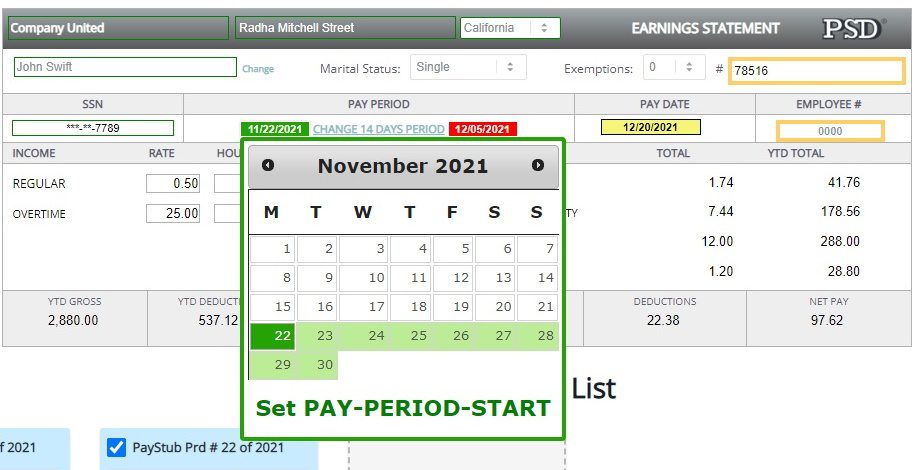

A pay period is a time frame for calculating the wages and the intervals in which employees receive their paychecks.

Pay periods are often fixed.

There are several types of pay periods including weekly, bi-weekly, monthly, or semi-monthly and this depends on the type of employees and their salary range

How are pay periods determined?

Sometimes pay periods are determined through the salary range, or it may depend on holidays or the start date of the employee.

It could also depend on how operations have commenced on a certain organization.

Pay Period Types

Weekly Pay Period

Benefits

Your employees get paid right away. They don’t have to wait for a long 14-day period to get their paychecks.

Drawbacks

It can be costly to operations and it can be a hassle to constantly make up for pay period intervals belonging to this category.

Biweekly Pay Period

Benefits

Employees are paid every other week on a specific day of the week. So if the pay period is on a Friday, their next pay period will be Friday in the next 2 weeks. It’s also a lot more feasible for many staff because there are 3 pay periods in a month.

Drawbacks

Employees may have to wait a little longer. And you have to comply with a specific business day so your payroll must ensure that checks go through and make up for holidays that may come about thus causing hectic calculations. And you have to accommodate 3 pay periods in some months.

Semi-monthly Pay Period

Benefits

This gives you consistency since you pay your employees the same day each month. This is easier because just like the previous interval, you only pay twice a month and it makes benefits and taxes much faster to facilitate.

Drawbacks

Sometimes, the FLSA does not accommodate non-exempt employees easily because of overlapping pay periods. Some states also prohibit the use of the semi-monthly scheme for hourly staff.

Monthly Pay Period

Benefits

This is highly the most convenient payroll interval for business owners and CEO’s. It is faster to prepare and can offer more flexibility for budgeting. And it also gives the management time to prepare for future positions.

Drawbacks

Some states prohibit the administration of monthly pay periods under the FLSA.

Pay Period FAQ's

Can a pay period change?

The Fair Labor Standards Act (FLSA) does not prohibit the changes of pay periods.

However changes usually must be reflected on the contracts and it should be agreed upon with your staff.

How many pay periods are in a month?

As we mentioned above, there can be 2 pay periods for biweekly and 2 – 3 periods for semi-monthly. Hourly employees who are paid on a weekly interval are paid 4 times a month. Highly-paid staff though can receive.

Create a pay stub and set your own pay periods. Keep track of older pay periods too if you want to backtrack on previous income.