How to Get Your W2 From Your Previous Employer?

Filing your W-2’s is done at the end of every tax season.

If you’re working at a new job, or you’re currently unemployed and freelancing and need your W-2’s from your previous employer, you can take certain steps in retrieving this form so you can stay on top of tax season.

What is Form W2?

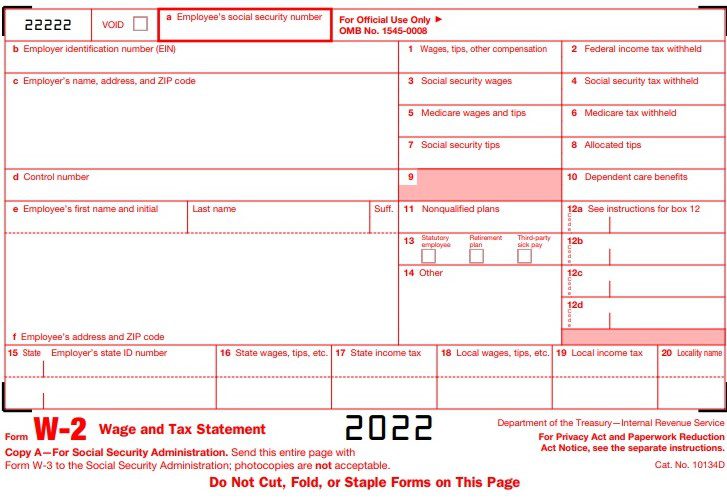

A W-2 form is a vital document to have if you want to file your annual taxes.

Why do you need a w2?

At the beginning of each year, employers ideally give W-2’s to all of their employees.

These forms include information about your income for the previous tax year and the taxes withheld.

W-2’s are important for filing your taxes but also tracking your net pay over time.

It includes information too which are pertinent to your own life such as Social Security, Medicare taxes, and your annual contributions to your retirement fund.

Additionally, you can track your previous employer’s contribution to your healthcare and how much dependent benefits you received.

The IRS typically requires your employer to mail you a copy of your W-2 prior to the end of January.

If in the first few weeks of the coming year you have not received it, then it may be time to take action.

The following are steps to making sure you receive your W-2 on time.

How to Get your W-2 from your Former Employer

1. Check the dates

Stay familiar with important tax dates.

Remember that January 31 is the date you should already have gotten your W-2.

February 14 is the grace period.

In fact, at Christmas, it might be a great idea to start thinking about those tax dates already.

2. Update your address and contact information

If there are any life changes you’ve made such as a change of status or change of address, then update them.

You can file your change of address form at the USPS.

After this submission, you can wait 7 – 10 days before the company processes your request.

3. Contact your former employer

You must initiate contact with your former employer if they have not yet filed it.

If you can’t talk to your manager right away, you may talk to your HR and payroll department.

Most of them are happy to assist you.

Simply tell them your intentions and make sure to facilitate this at the earliest parts of January.

4. Go online

You may need to check your emails.

If you have chosen to receive your forms online, you may also receive them digitally.

Search your inbox and spam to make sure that you don’t have your tax documents online.

5. Contact the payroll staff

If your former company has opted to outsource payroll to another party, you may opt to contact this administrator.

If they’ve kept records, they ought to have your W-2 because employers are tasked with keeping info on withholding taxes.

6. Contact the IRS

If it’s already Feb 14 and you still don’t have your W-2, it’s time to contact the IRS.

Give them the company’s Employer Identification Number or EIN as well.

If your former manager is not cooperative, then having calls from the IRS ought to get the ball rolling and they are then sent a reminder to give you your W-2.

What you Can do if you Can’t Get your W-2

Form 4852

You can also get Form 4852 if your employer does not provide it.

Form 4852 is used when the employer won’t give an employee a W-2 or if some pieces of information there are wrong.

Calculate your W-2 Wages from a Pay Stub

If you want to keep track of all your earnings, it is also possible to calculate your W-2 wages from a pay stub.

Recommended Reading: How to compute your W-2 income from your pay stubs.

Can you Get your W-2 Online?

Yes, you can.

Take note though in filing online, you should provide a copy of your Forms W-2 to an authorized IRS, electronic file provider.

This happens prior to the IRS provider sending an electronic return to the IRS.

Remember to keep all paper documents safe, if possible make a backup copy of your electronic files in your own Email.

If you want to file your W-2 income using pay stubs, you may also create pay stubs now.

An online pay stub generator makes calculations faster and more efficient.

We hope you found this article useful, and it’s better to act on your W-2s prior to tax season.