Free estimate • 2026

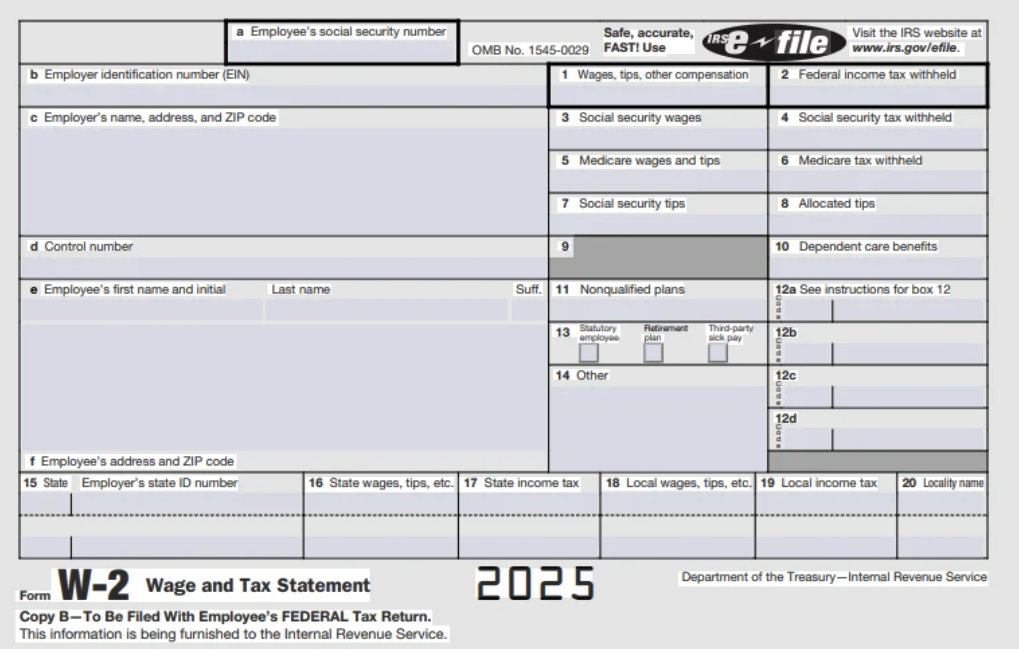

W2 Tax Calculator

Turn pay stub numbers into a quick W‑2 box estimate. Enter your pay frequency, gross pay, deductions, and withholding to estimate Boxes 1, 2, 3, 4, 5, 6, 16, and 17.

Estimates are for planning/preview only. Your employer’s payroll setup and state rules can change exact results.

Tip: If you have a year-end pay stub, use the YTD gross for the best estimate.