How to Generate an Invoice for your Business - Create an Online Invoice

The proper way to create an invoice for your business is to include a proper and transparent outline of your services, items and their respective costs. Invoicing can be done electronically, on paper or even on a mobile app.

The advantage of using an online invoice generator is that it allows you to save time and energy by automatically creating and sending your invoicing statements online and making changes before you hit preview and printing it out to PDF.

Do you need to Create an Invoice?

Generating an invoice is important.

People want to know the cost of your services and if you offer your services ahead of payment, you need to make sure you are able to send a bill.

This gives you a chance to make a professional impression, as well as to make sure you get paid for your services.

The Parts of an Invoice

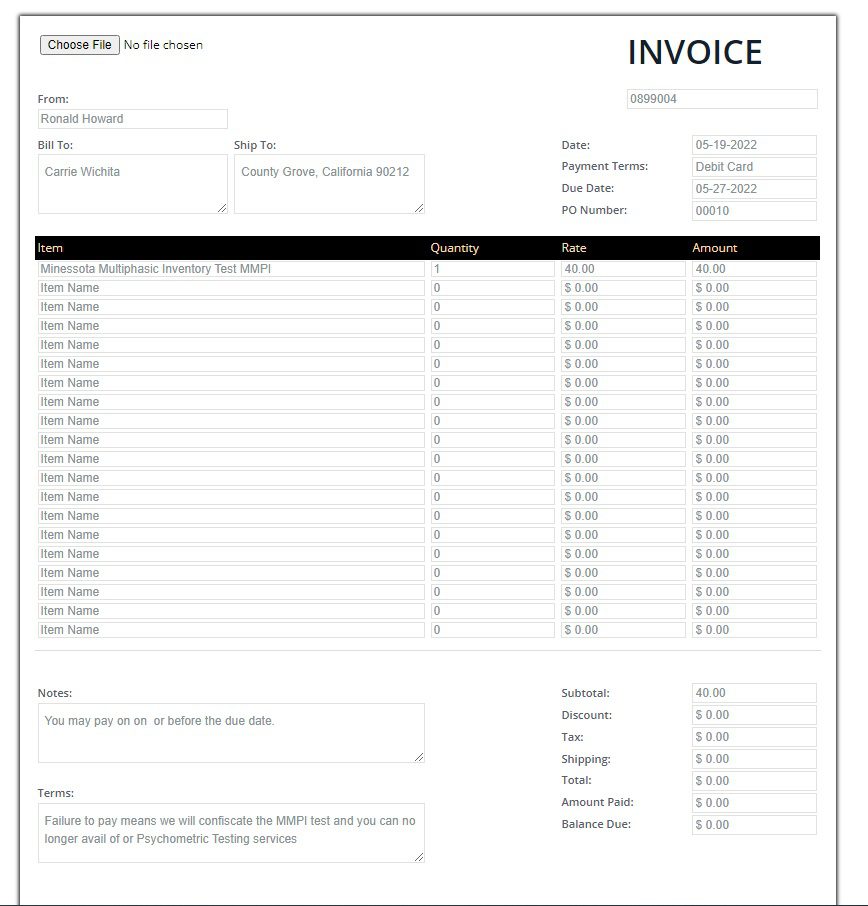

In creating your invoicing statements or billing statements , be sure to include the following information:

- Your name and contact information

- The name and contact information of the person or company you are billing

- A description of the services you provided

- The cost of those services

- The date the services were provided

- The date the invoice is due

- Payment terms

How to Create an Invoice - 10 Tips for Invoice Creation in 2022

Generating an invoice can be tedious. Online invoice generators, however give you a great advantage because you can make many changes because of the unlimited free previews of your template.

Here are 10 tips to make sure that you generate an invoice properly:

1. Make sure that your company name and information is on the invoice.

Your company name and address and other key information ensures that the billing goes to you and you are the legitimate receiver of these payments.

2. The invoice should have a unique identifier, like an invoice number.

Invoice number is crucial because this is unique to the person, or organization who is giving you the payments.

3. Include the date of the invoice and the date that payment is due.

Make sure to include the payment date so your customers can pay you on time.

4. Make sure to list the products or services being invoiced, including a description, quantity, and unit price.

Not only should you include the products, but you may need to include the make and model, including a description, unique serial number or codes and the price and quantity.

5. Include any discounts or promotions that are being offered.

Discounts or promotions which may reduce the price should be included. This reflects transparency and that you honor your promo.

6. Add up the total amount due and include any applicable taxes.

Include taxes if there are any applicable remittances to the payment.

7. Indicate what methods of payment you accept, such as credit card, PayPal, or bank transfer.

You must include your payment methods, and integrate these to your terms and conditions in buying and selling goods for your services.

8. Include your contact information in case the recipient has any questions about the invoice.

Your contact info is vital. In fact if you are a service provider or contractor, choose a standardized channel for your client to make contact with you.

9. Thank the recipient for their business.

You may include a thank you note when you email your invoices. Showing them you care increases the chances of them returning to you for help.

10. Sign and date the invoice to make it official.

You can use Online PDF Signature Tools digitally affix your signature or have them sign the billing statement to make it official.

Ready to make your own invoice?

Try our online invoice generator for free!