Direct answers to the most common questions people ask about 1099 forms.

What is the difference between 1099-MISC and 1099-NEC?

The 1099-NEC (Nonemployee Compensation) is used specifically for payments of $600 or more to independent contractors for services. The 1099-MISC is now used for other types of income like rent, prizes, royalties, and other miscellaneous payments. Before 2020, contractor payments were reported in Box 7 of 1099-MISC, but the IRS separated this into the new 1099-NEC form.

Who should get a 1099-MISC form?

Form 1099-MISC reports certain non-employee payments your business makes—commonly rent, royalties, prizes/awards, and some legal/medical payments. If you paid an individual/partnership/estate $600+ in reportable categories (or $10+ in royalties), you may need to issue a 1099-MISC.

Who needs to file a 1099 form?

Businesses must file a 1099 form if they paid $600 or more to a non-employee (independent contractor, freelancer, or self-employed individual) for services during the tax year. This includes payments for professional services, rent, royalties, and other types of income. You do NOT need to file a 1099 for payments made to corporations (with some exceptions for attorneys and medical payments).

When is the deadline to send 1099 forms?

For 1099-NEC: You must send copies to recipients by January 31, and file with the IRS by January 31. For 1099-MISC: Send copies to recipients by January 31 (or February 15 for certain types). File with the IRS by February 28 (paper) or March 31 (electronic).

How many copies of a 1099-MISC do I need?

Typically you provide a copy to the recipient and keep a copy for your records. You also file with the IRS (and sometimes your state). If you file electronically, your filing provider handles the IRS copy; if paper-filing, the IRS uses Copy A (official red form).

Do I need to file a 1099 if I paid less than $600?

Generally, no. The $600 threshold applies to most 1099 reporting requirements. However, you must still report the income on your tax return regardless of whether you receive a 1099. Some exceptions apply: royalties require a 1099 for payments of $10 or more, and backup withholding requires a 1099 regardless of amount.

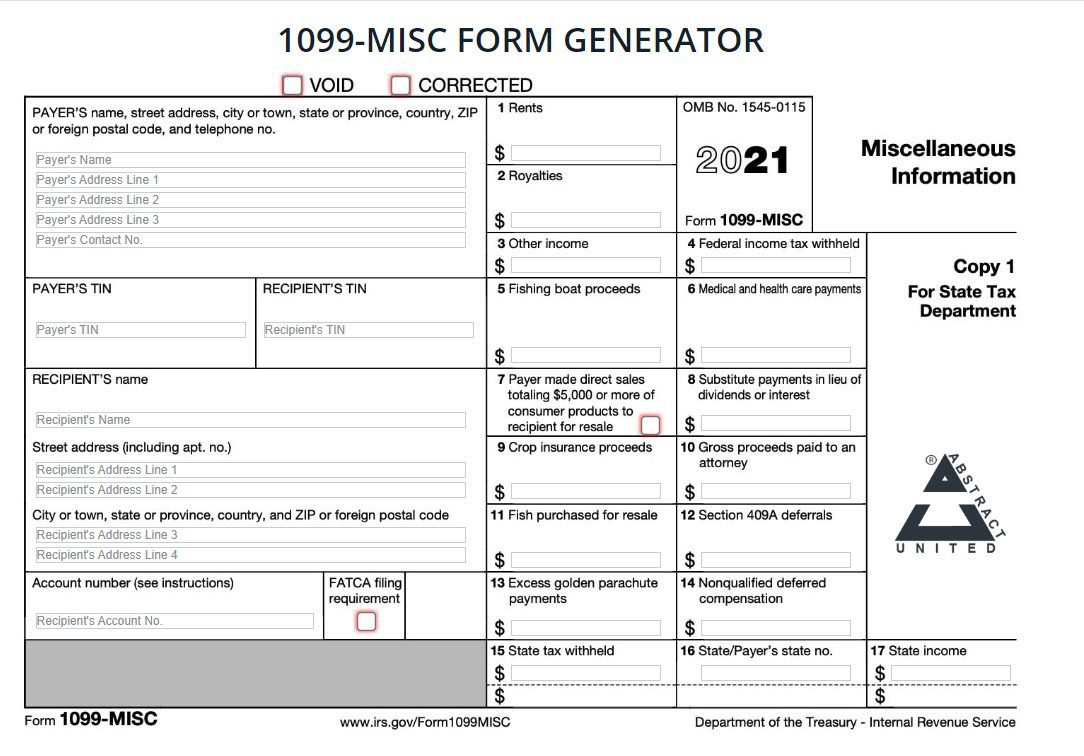

What information is on a 1099 form?

A 1099 includes payer and recipient information (name/address and EIN/SSN/TIN) and the dollar amounts reported in specific boxes depending on the payment type. It may also include federal/state withholding if applicable.

Can I create my own 1099 form?

Yes, you can generate 1099 forms using online tools like PayStub Direct. For official IRS filing, you need to use approved forms (red ink Copy A for IRS). For recipient copies and record-keeping, you can use generated forms. Many businesses use online generators for previews and recipient copies, then file electronically with the IRS.

What happens if I don't file a 1099?

Failure to file 1099 forms can result in IRS penalties ranging from $60 to $310 per form, depending on how late you file. If you intentionally disregard the requirement, penalties can be $630 per form with no maximum. The recipient may still need to report the income, and discrepancies can trigger audits.

What is the difference between a W-2 and a 1099?

A W-2 is for employees whose employer withholds taxes and pays part of Social Security/Medicare taxes. A 1099 is for independent contractors who are responsible for their own taxes (self-employment tax). Employees receive benefits and have taxes withheld; contractors have more flexibility but handle their own tax obligations.

Do independent contractors need pay stubs?

Independent contractors don't receive traditional pay stubs like employees, but many create their own for record-keeping, loan applications, rental applications, and tax preparation. A contractor pay stub helps document income throughout the year and provides proof of earnings when needed.

How do I know if someone is an independent contractor?

It depends on behavioral control, financial control, and the relationship type (contracts/benefits). If you control how/when the work is done like an employee, they may be an employee; if they control their process and work for multiple clients, they may be a contractor. When in doubt, consult a tax pro.